Taxes

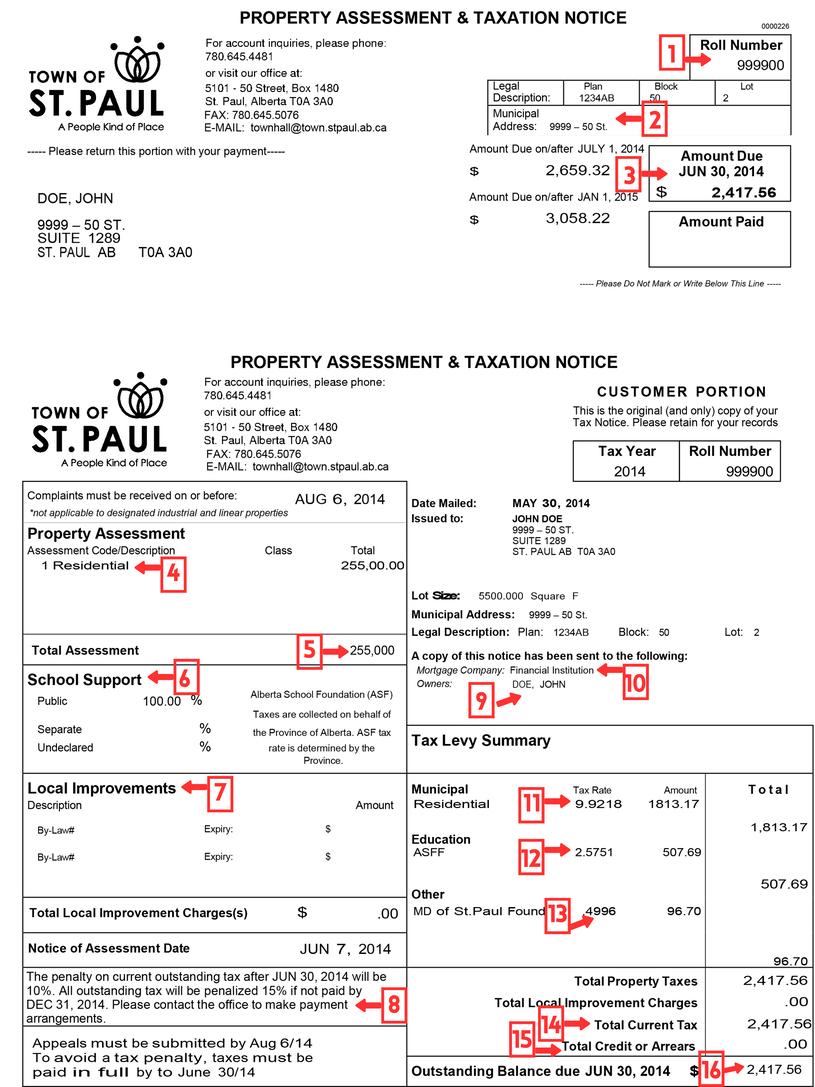

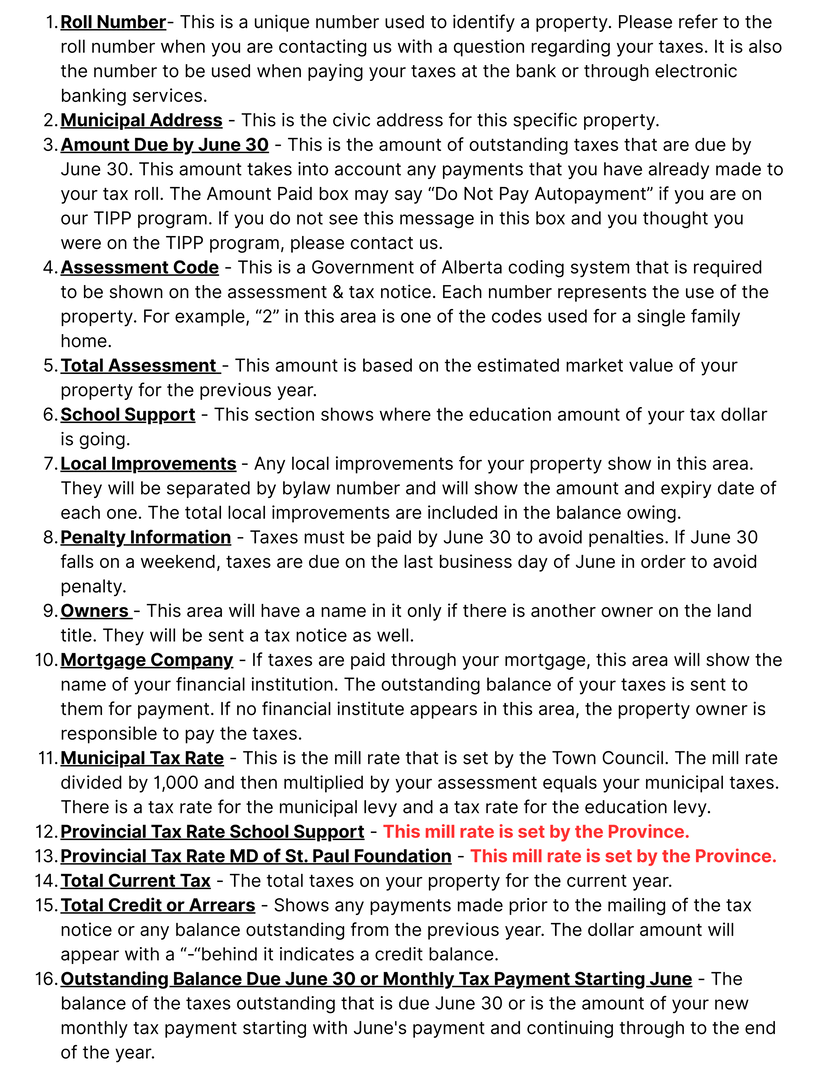

Taxes are sent no later than June 1st and are due June 30, 2025 and you can pay them at the office by cheque, cash or debit. If you are unable to come into the office, you are able to make payments through online banking or telephone banking. You can also set up automatic withdrawals by filling out a form and including a void cheque. In order to set this up you must have your taxes paid in full and submit everything before the end of December to begin auto-payments for the following tax year.

The 2025 Summary Due Dates are as follows:

- Residential is June 30, 2025

- Non Residential is June 30, 2025

- Penalties - in the amount of 10% - will be applied to both Residential and Non-Residential - on any amounts outstanding - on July 1, 2025.

Taxes unpaid by the July 1, 2025 will be subject to a 10% penalty. If taxes are still not paid by January 1st of the following year there will be another 15% penalty applied to the any amounts outstanding.

Deadline to file an appeal is July 22, 2025

To file an appeal: Assessment Review Board Complaint Form

Payments can be made via:

Payments can be made using any of the following methods:

- Online/Telephone Banking: Use your roll number as your account number when paying through your financial institution.

- By Mail | It is your responsibility to be aware of the potential Canada Post Strike: Make your cheque payable to Town of St. Paul.

- In Person at Town Hall | 5101-50 Street | Monday - Friday 8:30am to 4:30pm: We accept cash, cheque, or Interac. Please confirm your daily transaction limit with your bank prior to paying by debit.

- Credit Card: Payments can be made via OptionPay, a third-party provider. Please note that service fees apply and are the responsibility of the cardholder. OptionPay is accessible through our website and in person.

- Installment Plan: To help with budgeting, we offer a tax installment plan. To qualify, any outstanding taxes from previous years must be paid in full, and a pro-rated payment for the current year must be made.

Important Dates:

- May 15: Property Taxes Mailed Out

- June 16: Open House - 10am to 4pm

- June 18: Open House - 8:30am to 12pm

- June 30: Deadline for Payment

- July 1: 10% Penalty will be applied on current tax levy.

- July 22: Assessment Appeal Deadline

Open House Appointments:

These appointments are held at the Town of St. Paul Administration Office. To book an appt, please call 780-645-1756.

- Monday, June 16: 10am to 4pm

- Wedneday, June 18: 8:30am to 12pm